| |

|

|

Our Services

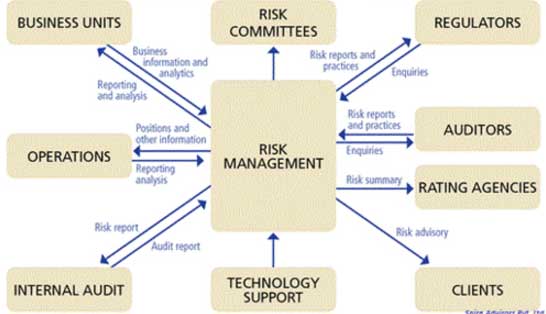

Risk Management

Leading Service Provider of Enterprise Risk Consulting, Integrated Internal Audit (IIA), Risk Based Internal Audit (RBIA), Concurrent Audit, Enterprise Risk Management and Due Diligence from Mumbai.

Enterprise Risk Consulting

In an environment where growing challenges require business resiliency, it takes a deft combination of strategic advice and innovative solutions to manage risk. We provide clients with strategic advice and innovative solutions across a wide range of insurable and non-insurable risks. Unlike management consulting firms with risk divisions, risk is our sole focus - which is why companies consistently call upon us to handle their most challenging business issues. In an environment where growing challenges require business resiliency, it takes a deft combination of strategic advice and innovative solutions to manage risk. We provide clients with strategic advice and innovative solutions across a wide range of insurable and non-insurable risks. Unlike management consulting firms with risk divisions, risk is our sole focus - which is why companies consistently call upon us to handle their most challenging business issues.

We manage risk strategically, with bespoke solutions designed to meet not only risk management objectives, but also overall business goals. Using industry-leading data and analytics, we evaluate exposures and risk management program gaps, helping clients determine their return on investment and make informed decisions about program adjustments and direction.

In short, our Enterprise Risk Consulting services help companies change their risk profiles so they can improve resiliency, reduce claims, and minimize costs. We can help you understand the likelihood and impact of diverse risks on your operations, and monitor, manage, and reduce the impact of those risks. You can recover from losses faster, take advantage of emerging business opportunities, and achieve business objectives.

Integrated Internal Audit (IIA)

Traditionally IA model has been reviewing and testing past events or transactions that identifies past issues and problems but fails to inform stakeholders on how the company is doing today and areas with scope for further improvement. Hence, there is a need for new, more proactive, IA model that respond to the existing stakeholders concerns about greater assurance, maximized business performance processes and broader risk management efforts, while providing for traditional compliance audits as well. Traditionally IA model has been reviewing and testing past events or transactions that identifies past issues and problems but fails to inform stakeholders on how the company is doing today and areas with scope for further improvement. Hence, there is a need for new, more proactive, IA model that respond to the existing stakeholders concerns about greater assurance, maximized business performance processes and broader risk management efforts, while providing for traditional compliance audits as well.

An Integrated Internal Audit approach simultaneously emphasizes on the organizations financial, operational and IT control process instead of separate or parallel audits. Integrated audits promote the philosophy of risk based auditing. It also helps to holistically consider and evaluate the risk and focus the audit efforts in the highest impact areas. Integrated auditing provides greater assurance that the audit function can appropriately identify risk originating from both operational and IT activities within the control environment. By enhancing the collaboration between business process and IT resources it is possible to have a better alignment across all business areas.

Integrated Audit Method 1: Under this methods both the teams work together in tandem while sharing the information at each of the three stages of audit execution i.e. planning, fieldwork and reporting. There are several key points of integration where teams have an opportunity to share the information and collaborate to maximize the effectiveness of the audit execution process.

Integrated Audit Method 2: This method differs from the first in that after the business process team completes the audit risk assessment and planning, the IT component of the actual audit execution is done first. The findings are shared with the business process team that determines whether any scope adjustments are necessary prior to audit execution by the business process team.

Risk Based Internal Audit (RBIA)

The Companies Act 2013 has laid down specific responsibilities on the Board, Audit Committee & Auditors with respect to its Internal Financial Controls & Risk Management system. SEBI with the objective to align its provisions to requirements under the Companies Act, 2013, has specifically reviewed “Clause 49†of the Listing Agreement to adopt leading industry practices on Corporate Governance & make Corporate Governance framework more effective. The Companies Act 2013 has laid down specific responsibilities on the Board, Audit Committee & Auditors with respect to its Internal Financial Controls & Risk Management system. SEBI with the objective to align its provisions to requirements under the Companies Act, 2013, has specifically reviewed “Clause 49†of the Listing Agreement to adopt leading industry practices on Corporate Governance & make Corporate Governance framework more effective.

The requirements of these norms necessitate Management to provide enhanced assurance to all the stakeholders i.e. the Board, Audit Committee and Auditors. Internal Audit function being suitably positioned, to be an enabler of good corporate governance, must therefore provide comprehensive support to these stakeholders in fulfilling their oversight responsibility and legal duties. Hence, there is an increased need for Internal Audit function to evaluate & redefine its role & methodology to be in sync with current regulatory framework.

The Act places a stronger emphasis than before on the role of the Audit Committee on internal financial controls and risk management. Given the importance of these areas, internal audit's assurance role is very important in helping audit committee directors fulfill their oversight responsibility and legal duties.

The main objective of Internal Audit is that it functions as a service to management by providing independent, management oriented advice on an organization's operations and performance and financial services. It aims at the promotion of efficiency, economy and effectiveness of the management processes, and also the reliability and accuracy of operations.

Concurrent Audit

Banks, Financial Institutions, Insurance Companies, Mutual Fund Companies and Large organizations and corporations need to verify day to day business transactions. We have a pool of qualified & experienced professionals and ancillary staff, to conduct such audits on a recurring basis. Banks, Financial Institutions, Insurance Companies, Mutual Fund Companies and Large organizations and corporations need to verify day to day business transactions. We have a pool of qualified & experienced professionals and ancillary staff, to conduct such audits on a recurring basis.

Due Diligence

With globalization and the rapid growth in the Indian economy mergers, takeovers, and acquisitions have become common phenomena. It is imperative to have reliable, timely and qualitative information in any potential transaction to enable informed decision making. With globalization and the rapid growth in the Indian economy mergers, takeovers, and acquisitions have become common phenomena. It is imperative to have reliable, timely and qualitative information in any potential transaction to enable informed decision making.

Due Diligence refers to the process of research and analysis that is done before an acquisition, investment, business partnership or bank loan in order to determine the value of the subject of the due diligence or whether there are any major issues or potential issues. The prospective acquirer/investor should obtain all the necessary information within the predetermined time and make sure that he makes a good deal and not a costly mistake.

Our Due Diligence team performs financial, legal and tax due diligence and business analysis for organisations that are contemplating investments, strategic partnerships, mergers and acquisitions or that are looking to enhance organisational effectiveness in an existing business unit or portfolio company. We offer a confidential, sound, unbiased perspective and are the ideal complement to client's internal resources to generate valuable due diligence reports and business analyses for our client that become an integral component of their decision-making and negotiation processes.

We focus on providing value-added services that enhances client business decisions by combining a thorough understanding of technologies, logistics, corporate strategy and finance with an ability to summarize complex issues into concise and easily understood terms. Our Due Diligence Review Report states the outcome of the above engagement supported by findings in each area along with adjustments proposed to achieve the objectives of the engagement.

Internal Audit

The main objective of Internal Audits is that it functions as a service to management by providing independent, management oriented advice on an organisation’s operations and performance and financial services. It aims at the promotion of efficiency, economy and effectiveness of the management processes, and also the reliability and accuracy of operations. The main objective of Internal Audits is that it functions as a service to management by providing independent, management oriented advice on an organisation’s operations and performance and financial services. It aims at the promotion of efficiency, economy and effectiveness of the management processes, and also the reliability and accuracy of operations.

Internal Audit is an important tool of evaluating corporate governance processes and evaluating the risk management of a business organisation. Internal audit is an effective means of evaluating the efficacy of operations, the reliability of financial reporting, compliance with the corporate and statutory regulations, safeguarding of assets and various matters concerning the interest of the company, employees, stakeholders and society in general.

On account of the changing business dynamics, recent corporate failures and increased stakeholders accountability, internal audit has a vital role to provide the management with a clear, comprehensive and unbiased analysis of the functional efficiency of the organisation and also to suggest possible areas of improvements.

Internal is conducted in order to provide the client’s management with a clear, comprehensive and unbiased analysis of the functional efficiency of the organisation and to suggest possible areas for improvements. We strongly believe that Internal Audits are value addition exercise rather than a mere compliance exercise. Our Internal Audit services are designed to suit the individual client specific needs. It provides assistance to clients in managing their key business concerns, be it achieving strategic business goals, meeting operational challenges, complying with regulatory norms or managing reporting requirements.

Information System Audit

The growing dependence of most organisations on Information Systems and the related risks, benefits and opportunities, have made Information Systems Audit an increasingly critical tool for overall governance. Without assurance on Information Systems, enterprises cannot feel certain that the information on which they base their mission-critical decisions are reliable, confidential, secure and available when needed. An Information Systems Audit evaluates the Information Systems from different perspectives such as security, quality, efficiency, reliability, etc. and reports on the risks and its impact on the organisation and also suggest measures to eliminate or minimize the risks.

Information System (IS) Audit evaluates the adequacy of internal controls with regard to specific computer programs and the data processing environment as a whole. It ascertains whether computer systems safeguard assets, maintain data integrity and allow the goals of an organization to be achieved effectively and efficiently.

We provide professional services in the areas of Information Systems Audit which include evaluation of Information Systems & IT Controls considering Organisation standards and International Information Systems frameworks. Our team includes experienced computers professionals and qualified system Auditors (CISA, CISSP, DISA, etc) to conduct IS Audit.

Enterprise Risk Consulting

Environment, Health and Safety (EHS) management is emerging as a key challenge for large organizations. Site safety and health programs benefit from effective planning, full implementation and careful, ongoing management. Correcting common deficiencies are important not only to protect the health and safety of site workers, but also to maximize the benefit and cost effectiveness of site health and safety programs. Environment, Health and Safety (EHS) management is emerging as a key challenge for large organizations. Site safety and health programs benefit from effective planning, full implementation and careful, ongoing management. Correcting common deficiencies are important not only to protect the health and safety of site workers, but also to maximize the benefit and cost effectiveness of site health and safety programs.

Environmental and safety audits will play an increasingly important role in evaluating compliance of organization's environment and work safety programs through assessment of properties, facilities, processes, and operations against regulations and standards as well as internal policies and goals.

These audits are systematic and objective assessments of the status and performance of properties, facilities, processes and operations. They are a valuable management tool which can be used to identify and assess environmental and safety problems, and initiate corrective actions which ensure compliance with applicable environmental and safety laws and regulations and internal management policies and practices. Environmental and safety audits can also be used to assess the quality of the existing environmental management systems, and to foster additional initiatives to improve the performance of a facility.

|

|

|

|

|